Taxes removed from paycheck

Social Security and Medicare. Multiple jobs or spouse works.

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Complete a new Form W-4 Employees.

. These accounts take pre-tax money. The Federal Insurance Contributions Act authorizes. Use this tool to.

First you need to determine your filing status to. See how your refund take-home pay or tax due are affected by withholding amount. Florida Paycheck Quick Facts.

People who earn less than 4000 per biweekly pay period and whose employers opt in to the deferral will not have to pay that tax until Dec. In the United States there are typically four types of taxes that are taken out of a pay check. Estimate your federal income tax withholding.

The first step is filling out your name address and Social Security number. There are two types of payroll taxes deducted from an employees paycheck. Currently the amount of Social Security taxes withheld from your payroll is 62 percent of your gross wages up to a certain amount for 2018 only wages up to 128400 are.

You must meet certain requirements to be exempt from withholding and have no federal income tax withheld from your paychecks. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. In the United States the Social Security tax rate is 62 on income.

For a single filer the first 9875 you earn is taxed at 10. Since tax withholding is a legal requirement however you can choose to have no taxes withheld from your paychecks only if you meet certain criteria. Local Income Tax.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. You should check with your HR department to make sure. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments.

How Your Paycheck Works. If this is the case. Updated July 27 2017 The Internal Revenue Service requires your employer to take federal income tax out of your paychecks.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Only the very last 1475 you earned. Money you contribute to a 401k is pre-tax which means the contributions come out of your.

Enter your personal information. Florida income tax rate. What is the percentage that is taken out of a paycheck.

But calculating your weekly take-home. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds. Federal income tax Social Security tax Medicare tax and state income tax note that not all.

There are two types of payroll taxes deducted from an employees paycheck. However the taxes are only.

Understanding Your Paycheck Credit Com

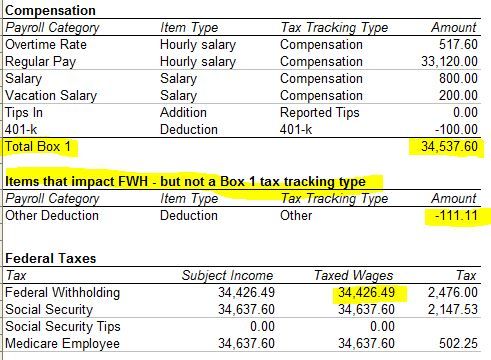

Solved W2 Box 1 Not Calculating Correctly

Paycheck Taxes Federal State Local Withholding H R Block

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Understanding Your Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Understanding Your W 2 Controller S Office

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Part 2 Salary Vs Actual Pay An Actual Paycheck In California Fashionfoodiela

What Are Payroll Deductions Article

Different Types Of Payroll Deductions Gusto

How To Withhold Payroll Taxes For Your Small Business

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora